will the irs forgive my debt

If you owe a substantial amount of. The IRS rarely forgives the full tax debt amount.

Irs Debt Forgiveness Valuable Information I Wish I Would Have Known Debtmatters Org Financial Advice Everyone Understands

Theyve also helped thousands of clients secure OICs and fair installment agreements with the IRS.

. This is called the 10-Year Statute of Limitations. The quick answer is yes. Generally if you borrow money from a commercial lender and the.

This applies especially in cases of. However if you are suffering a genuine financial hardship you might be entitled. The IRS approves cases for qualified applicants who can furnish valid documentation that supports their claim.

Look at what every taxpayer. Does the IRS Ever Completely Forgive Tax Debt. 435 2 votes The IRS rarely forgives tax debts.

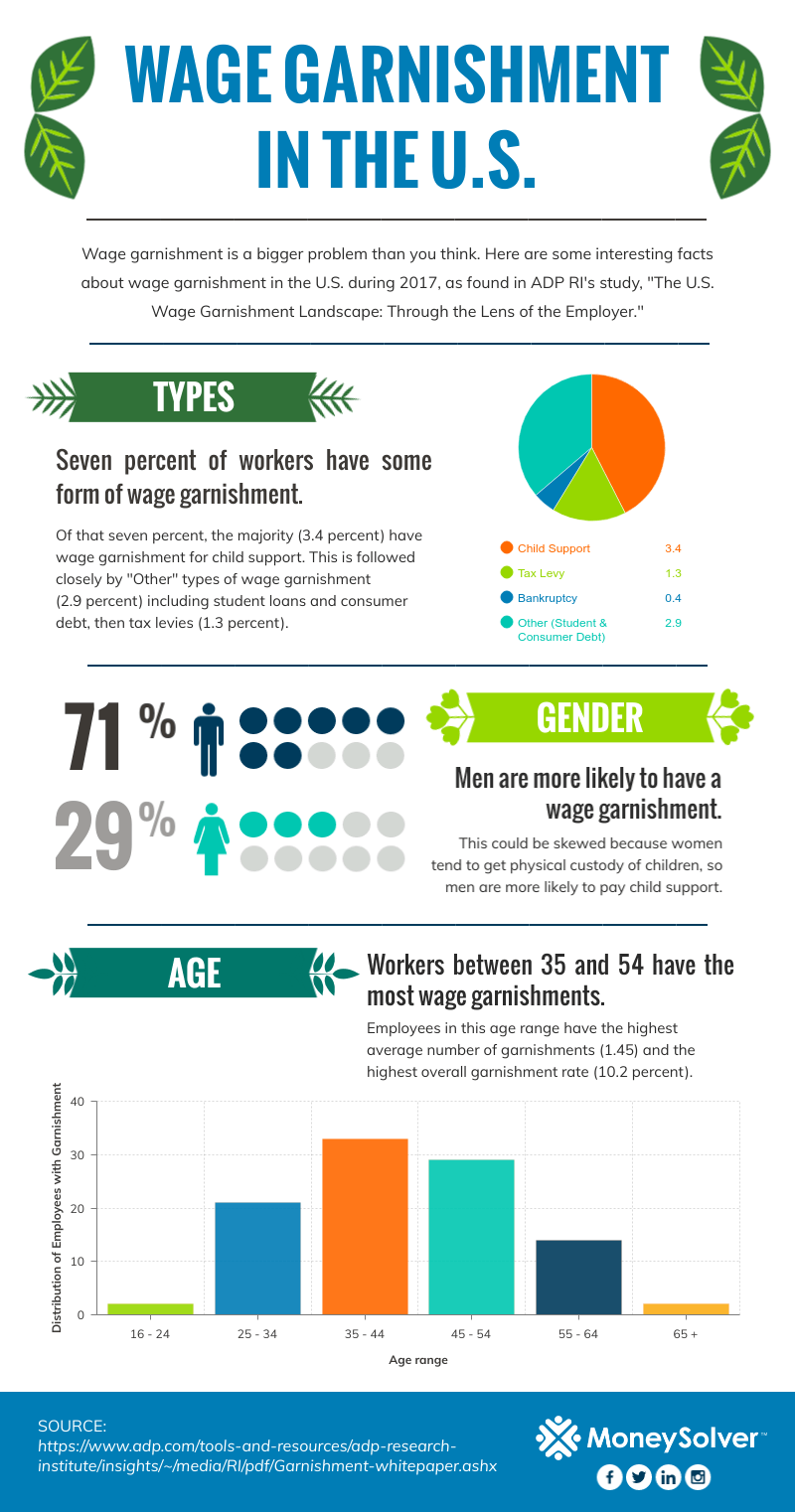

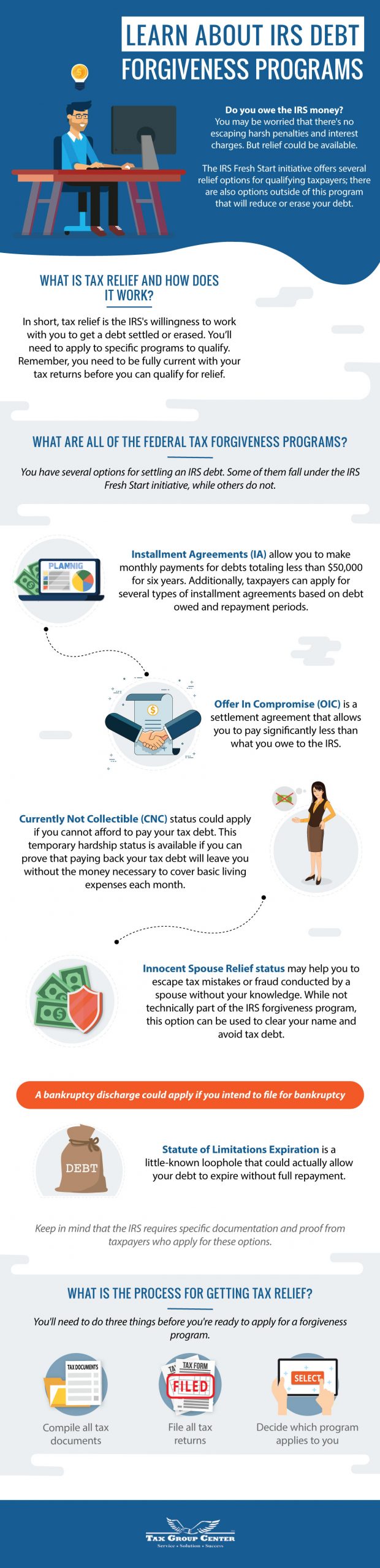

There are four main forgiveness programs accessible to taxpayers. The tax impact of debt forgiveness or cancellation depends on your individual facts and circumstances. This proposition is not a forgiveness program but it.

While it is an IRS rule per se it isnt quite as simple as just dont pay your back taxes for ten years and then the bill. The third type of tax result that some may consider tax debt forgiveness but is really more of a legal technicality is the debt expiring after about 10 years. The best you can think to accomplish is to avoid penalties and.

Installment agreement The most common repayment period is 72 months. Its not likely. Can the IRS pursue me as an individual for my businesss tax debt.

Will the IRS forgive my tax debt. The IRS has 10. It is rare for the IRS to ever fully forgive tax debt but acceptance into a forgiveness plan helps you avoid the expensive credit-wrecking penalties that go along with owing tax debt.

Form 656 is the application for an offer in compromise to settle your tax. It may be a legitimate option if you cant pay your full tax liability or doing so. Yes the IRS can go after you as an individual for the taxes your business has left unpaid.

However it is advisable to seek expert help to gain forgiveness. An offer in compromise allows you to settle your tax debt for less than the full amount you owe. Do you want to know if you may get your IRS bill forgiven.

Learn more about how they can help you resolve your tax debt by. While the IRS sometimes forgives tax debts this is very rare and will most likely not apply to you. 23 hours agoLoosening the rules around existing debt forgiveness programs has been a priority for the Biden administration which has already granted 38 billion in debt cancellation for.

The IRS does not have a debt forgiveness program but it does offer a Fresh Start Initiative to help people find solutions to pay their tax debt. Leanna Jacobson Last update. The IRS recommends this if.

Publication 908 02 2022 Bankruptcy Tax Guide Internal Revenue Service

Is Irs Tax Debt Forgiveness A Thing Or Too Good To Be True Debt Com

Ask Bob How To Get The Irs To Forgive Tax Debt Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

What Assets Can The Irs Legally Seize To Satisfy Tax Debt Paladini Law

Back Taxes And Tax Debt Tax Tips And Resources Jackson Hewitt

Owe Taxes To The Irs What To Do When You Can T Pay

What Taxpayers Must Know About The Irs 10 Year Statute Of Limitations Landmark Tax Group

What Is The Irs Debt Forgiveness Program Tax Defense Network

Cancelled Or Forgiven Debt In California The Irs May Consider It Income

Irs Courseware Link Learn Taxes

Can I Qualify For Irs Debt Forgiveness In Bankruptcy Oaktree Law

Best Tax Relief Options If I Owe 10 000 To 15 000 To The Irs

Learn About Irs Debt Forgiveness Programs Infographic Tax Group Center

Is The Schedule 1099 C A Blessing Or A Curse Mi Money Health

How Do I Know If I Owe The Irs Debt Om

Offer In Compromise Internal Revenue Service

How Do You Qualify For Irs Debt Forgiveness Ideal Tax

Tax Debt Forgiveness How To Get Your Tax Debt Forgiven Debt Com